Secure Your Legacy with Trusted Estate Planning Services

Prepare for the future with confidence. At Chris Pritt Law, PLLC, we help individuals and families in Charleston, WV create customized estate plans. Whether you need a will, trust, or power of attorney, we provide clear, caring legal support to protect what matters most.

What Happens Without a Solid Estate Plan?

Without a clear will, trust, or power of attorney in place, your loved ones may face confusion, delays, and financial strain. Taking time now to plan means your wishes are followed, and your family is protected from unnecessary stress and uncertainty.

Represented me well and had great communication.

Patrick L.

Lost Time and Money

Delaying your estate plan can lead to court costs, tax issues, and lengthy probate processes that drain both time and finances.

Missed Opportunities

Without a plan, you may lose control over how assets are distributed or who makes decisions on your behalf.

Stress & Regret

Lack of planning can create confusion and burden your loved ones.

Why Choose Chris Pritt Law, PLLC?

Estate Planning Guidance

We help you create wills, trusts, and powers of attorney to clearly protect your wishes.

Tailored Legal Plans

Every family is different. We create estate plans that reflect your specific goals and priorities.

Clear, Caring Support

We guide you through each step with clarity and care, so you feel confident about your future.

See Why Our Clients Trust Us

Esquire Pritt is a down to earth, very personable & approachable attorney. His moral & ethical code - as well as his faith in God - guides his decisions and solidifies his integrity. He will give you 100% every time.

⭐⭐⭐⭐⭐

Google Review

W. Todd. L.

Chris and Zane were awesome to work with! To say these guys went above and beyond on a very complicated property issue is a understatement!!!! We would highly recommend them for any issues you may have arise! They do not stop until everything is resolved. Not to mention everyone we dealt with was extremely pleasant to work with which is a breath of fresh air in today’s world.

⭐⭐⭐⭐⭐

Google Review

Melinda S.

Chris Pritt is a great lawyer! He listened intently to my needs and was pleasant and easy to work with! Highly recommend!!

⭐⭐⭐⭐⭐

Google Review

Lisa D.

How We Work Together to

Address Your Legal Needs

Schedule a confidential legal consultation

Meet with us to discuss your situation and explore your legal options.

Approve and begin representation

Once you’re ready, we’ll take action and advocate for your rights every step of the way.

Create a custom legal strategy

We'll create a customized plan for your case, ensuring every detail is covered.

Achieve your goals

With our support, move confidently toward resolution and a secure future.

Schedule a confidential legal consultation

Meet with us to discuss your situation and explore your legal options.

Create a custom legal strategy

We'll create a customized plan for your case, ensuring every detail is covered.

Approve and begin representation

Once you’re ready, we’ll take action and advocate for your rights every step of the way.

Achieve your goals

With our support, move confidently toward resolution and a secure future.

Call Any Time

(304) 720‐4412

Feeling Overwhelmed by Estate Planning?

We Can Help.

Introducing Chris Pritt Law, PLLC — your trusted legal partner for wills, trusts, and powers of attorney. Whether you're planning for the future or trying to protect loved ones, we’re here to provide clear guidance and support every step of the way.

What Sets Chris Pritt Law Apart:

Custom estate plans tailored to your life and goals

Deep understanding of wills, trusts, and powers of attorney

A focus on clarity, care, and long-term peace of mind

Don’t wait — schedule your consultation today and take the first step toward securing your future.

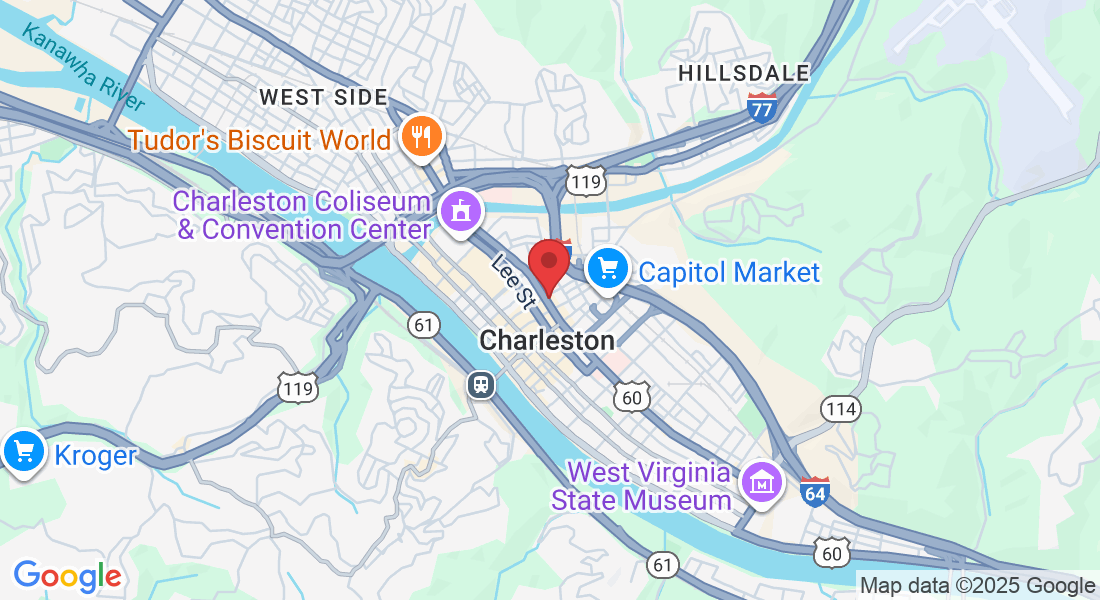

Address: 700 Washington Street, East Suite 204 Charleston, West Virginia 25301

Phone: (304) 720‐4412

Email: [email protected]

OFFICE HOURS

Monday-Friday: 8:30am – 5pm

Saturday & Sunday: Closed

Company Info

© Copyright 2025 | Chris Pritt Law, PLLC | Powered By Local Impact Agency